Home » Community Services » Tax

FREE Low Income Tax Clinic Registration

Tax Clinic has reached capacity and is not available for new registrations.

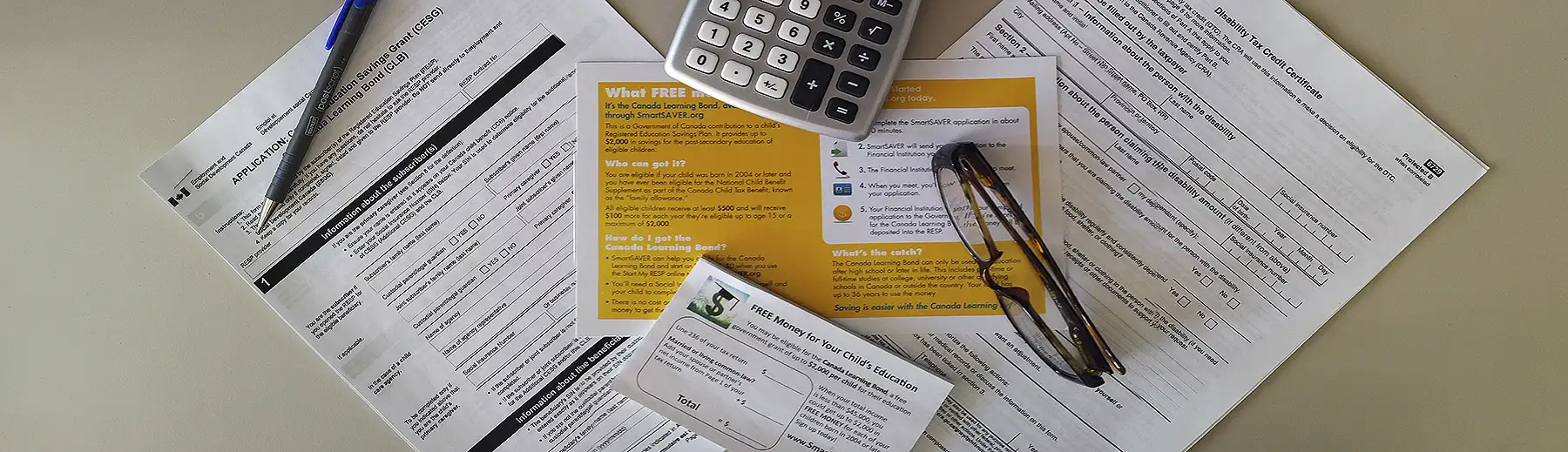

The Free Tax Clinic is for SIMPLE tax returns of individuals or families with income within the limits below.

- One person – $35,000 or less

- Two people – $45,000 combined (add $2,500 for each additional person in the family)

If your income is within the limits, confirm your tax return is simple.

A tax return is considered simple if an individual has no income or if their income comes from:

- Employment

- Pension

- Benefits such as Canada Pension Plan, Disability, Canada Child Benefit, Employment Insurance or Ontario Works

- RRSP

- Support payments

- Scholarships, fellowships, bursaries or grants

- Interest (under $1,000)

A tax situation is not simple when an individual:

- Is self-employed or has employment expenses

- Has business or rental income and expenses

- Has capital gains or losses

- Files for bankruptcy

- Is completing a tax return for a deceased person

A tax situation is not simple when an individual:

- Is self-employed or has employment expenses

- Has business or rental income and expenses

- Has capital gains or losses

- Files for bankruptcy

- Is completing a tax return for a deceased person

Applications will be accepted beginning March 4th. After you have read the three points above and confirmed you qualify, you may complete and submit the application. This clinic is for residents of Oshawa and Port Perry. Applications from area outside may be considered if space allows. For information and other help related to tax filing visit Durham Region Website: https://www.durham.ca/en/living-here/file-your-taxes.aspx

The volunteer tax clinic coordinator will review your submission and contact you by email as required. This is a volunteer-run program, so please note you may not receive an immediate response.

Get tax slips ready to send, either scan or take a clear picture of income slips T4’s, T4A, T4A(P), T4 (OAS), T4E, T4RSP, T5007, T5 charitable donations, medical receipts, daycare/child activities and rent receipts, etc. DO NOT send these documents until you are contacted by the coordinator.

Application Form for Low Income Tax Clinic has reached capacity and is currently unavailable for new registrations.